The daily price chart for SPY (S&P500 ETF) is showing a strong price pattern for upward movement of prices. This changed in the last two days because of the price action we had on this ETF, since April 25, 2012.

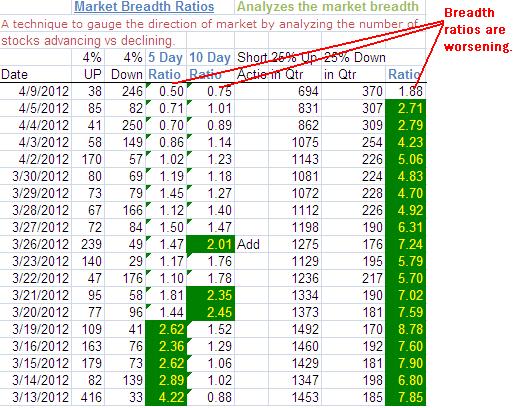

On the Market Breadth Ratios we went from a “Sell” signal to a “Buy” signal with 15 trading days. We got a “Buy” signal on this chart on 4/26/2012. This correction happened in a long term uptrend on S&P500 and Russell 2000 (representing the big cap and small cap indexes).

With the current correction being over we should buy good growth stock, with prudent risk management. Investor’s Business Daily is a good source for getting ideas on good growth stocks. They have lists like IBD 50, Sector Leaders for generating ideas about stocks showing strong fundamental and technical characteristics.